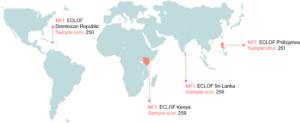

The 60dB Microfinance Index seeks a simple answer to a complicated question: What is the social impact of microfinance institutions? To this end, 60dB interviewed 18,000 microfinance clients from 72 MFIs across 42 countries. Collectively, these MFIs serve more than 25 million clients, more than 15% of all microfinance clients globally.

Among them were 1000+ ECLOF clients from four countries who answered a standardized set of questions around five common dimensions of impact: Access, Business Impact, Household Impact, Financial Management, and Resilience.

Here are some of the key findings:

- Microfinance can do a good job of reaching people without access to financial services: particularly women and lower income clients access loans for the first time through microfinance: This finding validates the core premise of microfinance: that clients can put loans to productive use in their businesses, and that business improvements will translate to improved household well-being.

- 1 in 3 clients report a ‘very much improved’ quality of life because of their microfinance loan: While the majority of clients report improvements in their quality of life because of the MFI loan, a full one-third of clients place themselves in the top ‘very much improved’ category.

- MFI clients report higher than average capacity to deal with an economic shock, and they say it is because of the MFIs: 1 in 3 of the clients in our Index would find it difficult to cover an emergency expense of 1/20th of Gross National Income per capita, compared to 1 in 2 globally, according to Findex.

- Group lending continues to be an important practice: Group lenders are better at reaching poorer clients, are more likely to reach women, and more likely to have clients who are accessing a loan from an MFI for the first time.

All ECLOF members scored favorably in the 60dB MFI index benchmarks. We’re particularly proud of ECLOF Kenya which was ranked 2nd out of 72 microfinance institutions world-wide. More so than their peers, ECLOF clients in Kenya reported significantly improved business and household income, increased resilience to shocks and strong understanding of the conditions and implications of borrowing.

Download the @60Decibels report now: https://bit.ly/mfi-index